News

What Is Euler Finance? Project, Token, Airdrop, Roadmap Explained

ChainPlay

•

22 days ago

Share :

What Is Euler Finance?

Euler Finance is an Ethereum-based non-custodial lending system. For ERC-20 tokens, it enables users to lend, borrow, and establish custom marketplaces. Euler allows permissionless listings, which let anybody construct a market under certain risk standards, in contrast to traditional lending platforms that limit listed assets.

EUL is an ERC-20 governance token and Euler's native token. EUL is used by holders to vote on protocol updates and treasury utilization, as well as in fee auctions and prizes. Flexibility and interoperability are guaranteed by the token's free movement across supported networks. Capital efficiency, risk management, and the modular flexibility that Euler V2 offered are the main themes of Euler's design.

How Does Euler Finance Work?

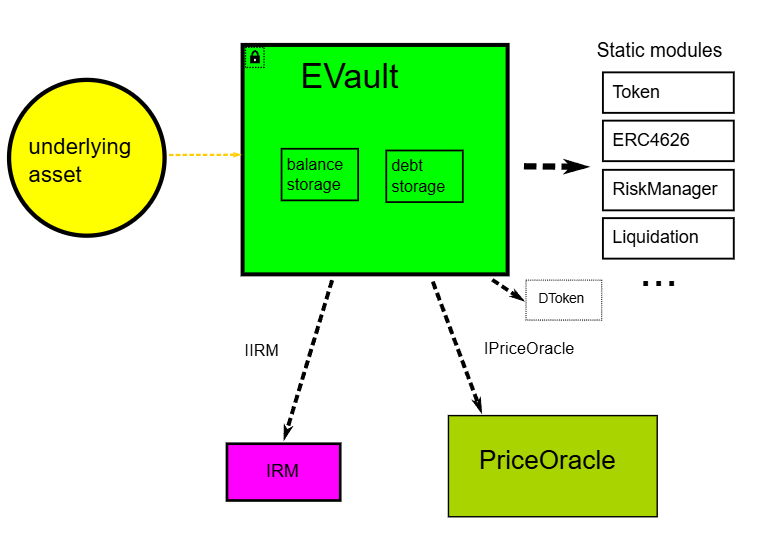

Euler works by allowing users to deposit digital assets and earn interest, or supply collateral to borrow other assets. The protocol operates under a modular system where each vault functions as a standalone lending environment.

Risk management in Euler relies on on-chain modules that adjust parameters such as interest rates and collateral ratios in real-time. The Euler Vault Kit (EVK) and Ethereum Vault Connector (EVC) help users customize their vaults. This setup ensures flexible borrowing conditions while keeping risk exposure transparent and manageable.

Governance, fee flows, and platform updates are managed through the EUL token, maintaining decentralization and user participation across the ecosystem.

Source: X

Euler Finance Team

Euler Finance is developed by Euler Labs, founded by three key individuals:

- Michael Bentley (Co-Founder & CEO): Holds a PhD in Dynamical Systems Mathematics from Oxford University and has contributed to automation in DeFi.

- Jack Prior (Co-Founder): A full-stack developer with over 11 years of experience, responsible for Euler’s frontend and user interface.

- Doug Hoyte (Co-Founder): A smart contract engineer specializing in risk logic and lending module architecture.

The team consists of blockchain engineers and quantitative analysts. Their work and quick recovery after the major hack in 2023 gained recognition in the DeFi community. They continue to play a major role in the growth of EulerSwap, the DEX integrated into Euler’s lending framework.

Source: X

Euler Finance Token

- Project Name: Euler Finance

- Token Ticker: EUL

- Blockchain: Ethereum

- Contract: 0xd9fcd98c322942075a5c3860693e9f4f03aae07b

- Total Supply: 27,812,818 EUL

- Circulating Supply: 18,685,530 EUL

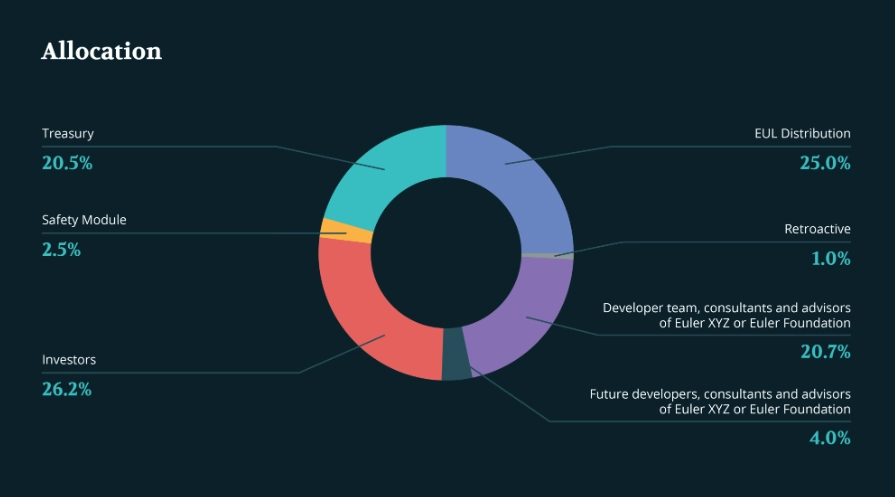

Token Allocation:

Euler Finance's utility and governance token is called EUL. Approximately 18,685,530 of its 27,812,818 EUL total supplies are in circulation at the moment. The distribution is set up to strike a balance between long-term development, community involvement, and investment rewards. The safety module receives 2.5%, while the treasury receives about 20.5% for ecosystem expansion. Early fundraising assistance is reflected in investors' 26.2% stake, while platform incentives account for 25%. Early users receive 1% in retroactive benefits, while the project team and consultants receive 20.7%. The remaining 4% is set aside for upcoming advancements. Through the Euler DAO, this allocation supports a balanced governance system while fostering growth, encouraging participation, and ensuring transparency.

Source: X

Euler Finance Fundings

Euler Finance raised a total of $40.8 million through several funding rounds:

- Seed Round (Dec 2020): Raised $800,000 led by Lemniscap with support from CMT Digital and others.

- Series A (Aug 2021): Raised $8 million led by Paradigm.

- Series B (June 2022): Raised $32 million with Haun Ventures leading, joined by Coinbase Ventures, Jump Crypto, Uniswap Labs Ventures, and FTX Ventures.

- April 2025 Round: Amount undisclosed, led by Wintermute, a leading market maker.

These fundings helped expand development, strengthen infrastructure, and support the launch of Euler V2.

Euler Finance Roadmap

Euler’s roadmap reflects its push toward scalability and modular design:

- Modular Lending Architecture: The focus is on splitting functions into independent modules for better flexibility.

- TVL Growth & Multi-Chain Expansion: Within six months of launching V2, Euler’s total value locked (TVL) grew from $99 million to $671 million. The protocol expanded to networks like Base, Swell, Sonic, and Bera.

- Governance and Security: Euler launched the Euler Governance Platform (EGP) to centralize voting and proposal management. The project invested $4 million in security, conducted 45 audits across 13 firms, and hosted one of DeFi’s largest bug bounty programs.

Euler Finance Security

Code Security:

Euler’s code has gone through over 40 audits by 16 leading Web3 security firms. The system uses advanced testing methods, including fuzz and formal verification testing.

Before its launch, Euler held a $1.25 million security challenge through Cantina, where no critical vulnerabilities were found.

Live Mainnet Challenges:

Euler also ran live Capture the Flag (CTF) competitions:

- $3.5M Euler Protocol CTF (Hats Finance) – tested the core system with real funds.

- $500K EulerSwap CTF (Cantina) – tested the new DEX system.

Ongoing Security:

- Bug Bounty Program: Rewards up to $7.5 million for critical discoveries.

- Active Monitoring: Managed by top-tier security platforms.

- Emergency Response: The protocol can pause or upgrade functions during a threat.

Application Security:

The user interface is audited, protected by Cloudflare, and meets ISO 27001 compliance standards. This includes DDoS protection and DNS security.

Euler DAO

Around 34% of EUL tokens are managed by the Euler DAO, used for ecosystem growth and governance. Holders can vote on treasury spending and protocol updates.

- 1% (271,828 EUL): Distributed to early users in 2021.

- 0.18% (48,100 EUL): Used as Uniswap v3 liquidity following a governance vote.

- 22.9% (6,236,107 EUL): Held in the DAO treasury.

- 6.3% (1,712,517 EUL): Distributed to users as rewards between 2021–2025.

The DAO maintains transparency and active participation through proposals and community discussions.

Source: X

Key Features and Benefits of Euler Finance

Euler V2 introduced a modular structure where each vault functions as its own lending protocol. This model allows customization for collateral, interest rates, and risk settings.

- Euler Vault Kit (EVK): Lets anyone deploy custom ERC-4626 vaults.

- Ethereum Vault Connector (EVC): Enables multiple DeFi actions—deposit, borrow, swap—in one transaction.

- EulerSwap: A decentralized exchange integrated with Euler V2. It combines token swapping and lending, doubling capital efficiency. Liquidity providers earn from both lending interest and trading fees.

EulerSwap also uses Uniswap v4’s hook architecture, allowing pool creators to define price curves and fee structures. This flexibility creates smarter liquidity pools tailored to specific trading needs.

Source: X

Potential Risks When Joining Euler Finance

Although Euler Finance is innovative and secure, it still carries certain risks. Smart contract risk remains the biggest concern in DeFi, as vulnerabilities or logic errors could lead to exploits like the one that once cost Euler $197 million. Liquidation risk is another factor since rapid market changes can reduce collateral value and trigger forced liquidations. The platform’s multi-chain expansion also introduces security and scalability challenges, such as bridge risks and gas costs. Governance risks may occur if token concentration allows large holders to dominate decisions.

Finally, the stability and accessibility of EUL may be impacted by changes in regulatory regulations and market volatility. Although these risks are lessened by Euler's robust security and open governance, users should always exercise caution when managing risk and keep themselves informed when taking part in DeFi lending.

How To Get Euler Finance Airdrop?

Binance has introduced Euler (EUL) as the 51st project on its HODLer Airdrop program. Euler is described as a DeFi super app that brings together lending, trading, and customizable markets with deep liquidity.

Users who staked BNB in Simple Earn or On-Chain Yields products between 07:00 on October 4 and 06:59 on October 7 (UTC) are eligible to receive EUL airdrop rewards. The tokens will be distributede directly to eligiblusers’ spot wallets at least one hour before trading opens.

Binance will officially list EUL on October 13 at 21:30 (UTC) with trading pairs including USDT, USDC, BNB, FDUSD, and TRY. EUL is marked with a “seed tag”, which identifies early-stage crypto projects that may carry higher risk due to limited product maturity. Eligible users can check their Binance wallets for EUL balances once the airdrop distribution is complete.

Source: X

What Is the Date of Euler Finance TGE?

Binance announced Euler as its 51st HOLDer Airdrop project. Users who staked BNB or On-Chain Yields between October 4–6, 2025 (UTC) received airdrop rewards.

Trading for EUL/USDT, EUL/USDC, EUL/BNB, EUL/FDUSD, and EUL/TRY opened on October 13, 2025, at 14:30 (UTC). Users could start depositing EUL at 10:30 (UTC) the same day.

Euler Finance Review: Final Thoughts

Euler Finance represents a strong blend of innovation, risk control, and user freedom. Its permissionless design and modular architecture open lending opportunities for a wide range of crypto assets.

Security measures, multi-chain expansion, and the integration of lending with swapping through EulerSwap mark an important evolution in DeFi. However, the platform still faces risks like contract vulnerabilities, market volatility, and governance imbalance.

Euler's technical maturity and resilience are demonstrated by its capacity to bounce back from its previous exploit and keep growing. It continues to be one of the most ambitious DeFi ecosystems for customers seeking sophisticated lending technology, flexibility, and transparency as the initiative expands.

More News:

Share this article

#Other

Latest News

Hollow Wave Brings New Quests and Rewards to My Neighbor

15 hours ago

Best Crypto Casino 2025: JACKBIT Leads the Charge as

yesterday

The Professional Approach: Applying Pro Gaming Discipline

yesterday

How casino bonuses influence player behavior and long-term

2 days ago

NEXUS and Redlab Partner to Grow Onchain Gaming on

2 days ago

Related articles

Learn how applying pro gaming discipline to casino games can improve your results. We cover the mindset, health, and math needed to win.

ChainPlay

•

yesterday

Read our 2025 JACKBIT review. We test its instant crypto withdrawals, No-KYC policy, 6,000+ games, and wager-free Rakeback bonus.

ChainPlay

•

yesterday

Join Hollow Wave, the final $ALICE Airdrop chapter in My Neighbor Alice. Play, craft NFTs, and earn from a 250k $ALICE prize pool until Dec 2.

ChainPlay

•

15 hours ago