The State of GameFi 2022 survey is the first in an ongoing series of yearly reports that offer insight into the shape of the industry. Thanks to all who participated for their thoughts and perspectives.

75% of respondents said they got into crypto solely because of GameFi. Translate this to simpler values, and you realize that three out of every four crypto investors worldwide start investing in cryptocurrency because of GameFi.

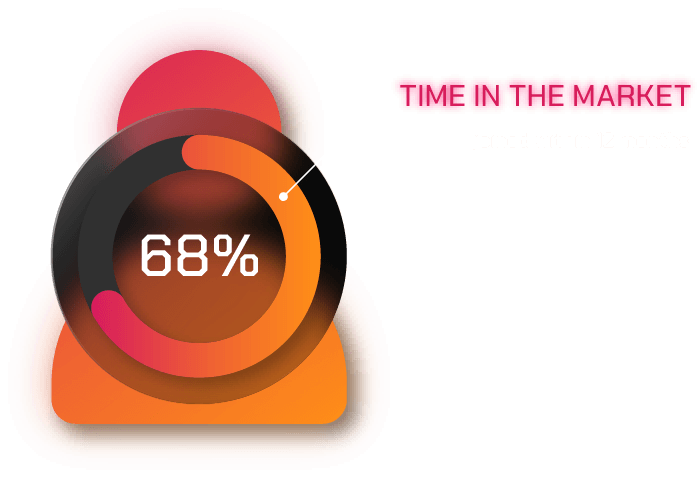

68% of GameFi investors only joined the market in the last 12 months, with many getting on board during the last two quarters of 2021.

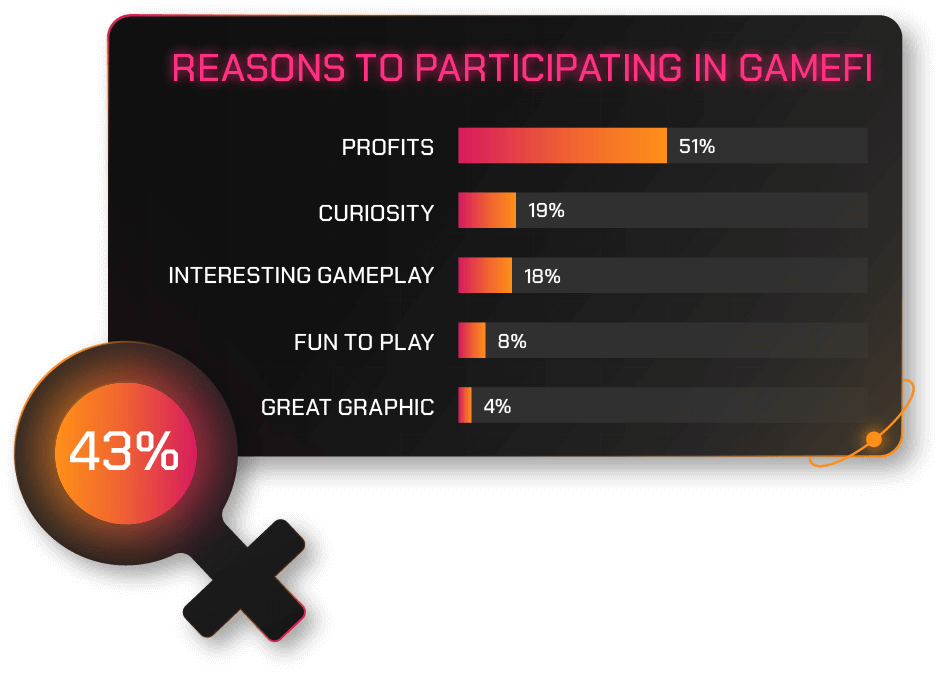

GameFi has for the longest time been known as the chance to make money from video games. It is no surprise that 51% of the respondents said profits are their number one reason when joining GameFi.

At the same time, curiosity ranks as the major driving force that influences female investors to participate in the sector. A whopping 43% of female investors said they participate in GameFi out of sheer curiosity.

Among all age groups, GenZ was the most open to GameFi. GenZ investors allocate 52% on average of their net worth to GameFi.

According to the survey, 89% of crypto investors worldwide saw their GameFi profits decrease in the last six months. 62% of respondents lost more than 50% of their profits from GameFi.

58% of investors worldwide stated that “Poor In-game Economy Design” is the number one reason for declining GameFi profits in the last six months.

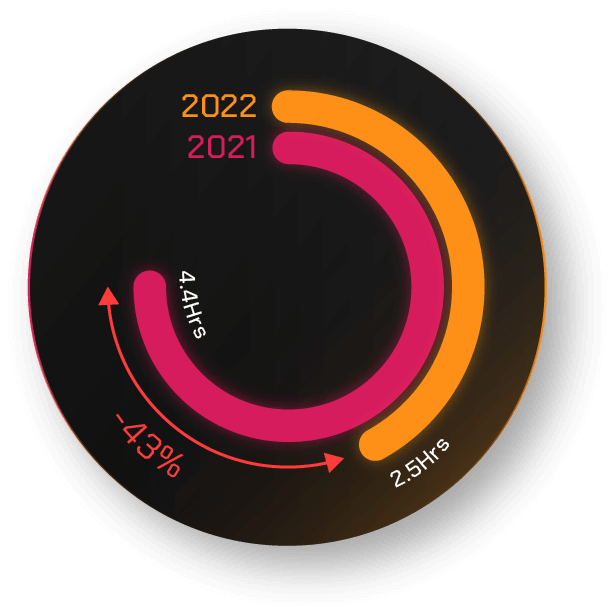

Investors worldwide spent an average of 2.5 hours per day participating in GameFi, which is down 43% compared to 2021 (4.4 hours)

73% of the respondents shy away from GameFi investments because they are afraid of rug pulls, Ponzi schemes, and pyramid schemes projects.

81% of GameFi investors prioritize the fun factor over earnings when it comes to future GameFi projects.

GameFi will still need an "Earn" factor, but future GameFi projects should focus more on improving game quality. The whole point behind video gaming, be it GameFi or traditional gaming, is to create positive experiences first. Earning ought to be a secondary, not a primary goal.

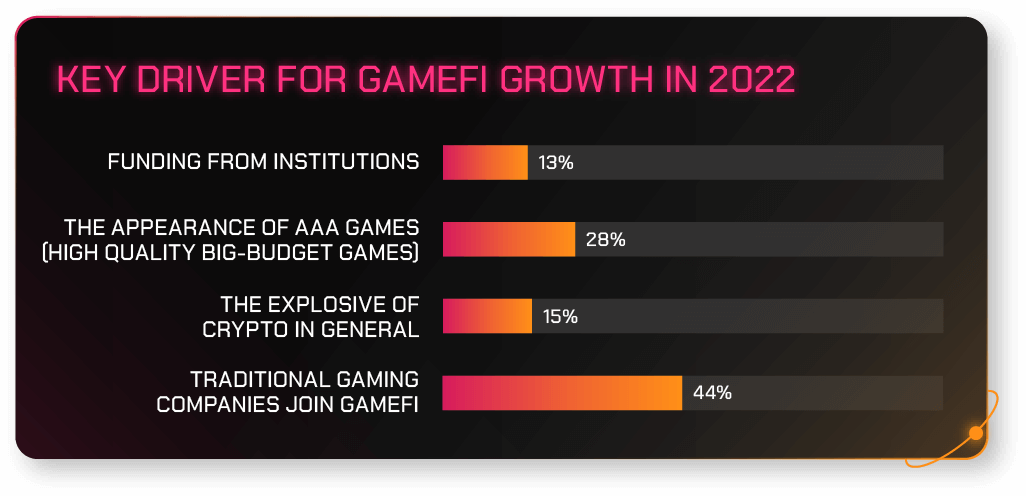

44% of investors who believe that the entry of traditional gaming companies into GameFi is the key driver for GameFi's growth in 2022

GameFi, the blend of virtual gaming and decentralized finance, took over the crypto space especially in late 2021, when the sector was at its peak. However, sentiments about this virtual gaming economy are getting more critical by the day. Through the survey, we hoped to understand from a first-party point of view how GameFI is doing presently. Let’s explore some of the findings we gathered.

The GameFi boom of 2021 fueled a significant increase in crypto investments. To understand how far GameFi impacts cryptocurrency as a whole, we began our survey by asking the selected investors how they got into crypto.

Interestingly, 75% of respondents said they got into crypto solely because of GameFi. Translate this to simpler values, and you realize that three out of every four crypto investors worldwide start investing in cryptocurrency because of GameFi.

The GameFi industry is still in its infancy stage. This means that most investors haven't had a very long investment period. In fact, 68% of GameFi investors only joined the market in the last 12 months, with many getting on board during the last two quarters of 2021.

GameFi has for the longest time been known as the chance to make money from video games. So it is no surprise that 51% of the respondents said profits are their number one reason when joining GameFi.

At the same time, curiosity ranks as the major driving force that influences female investors to participate in the sector. A whopping 43% of female investors said they participate in GameFi out of sheer curiosity.

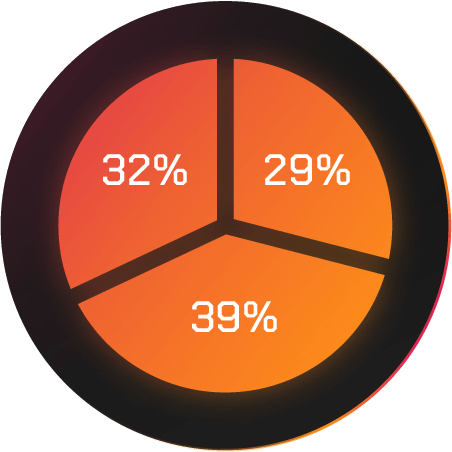

For 29% of the interviewed investors, short-term investments, going for less than three months, are their preferred investment style. 39% of investors work with mid-term investments, ranging from three to six months, and 32% of high-risk investors prefer long-term investment styles that go for more than six months.

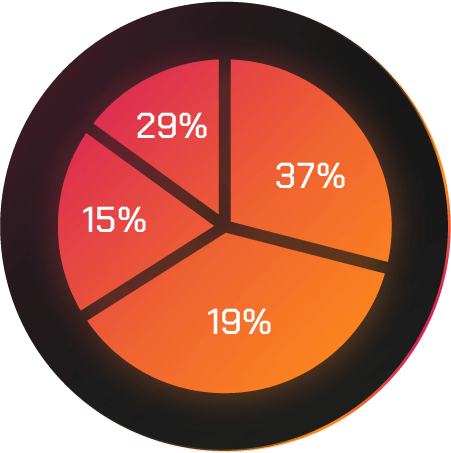

According to our survey, 29% of investors allocate less than 25% of their networth to GameFi investments, 37% of investors put in between 25% - 50%, 19% invest between 51% - 75%, while 15% of investors put in more than 75% of their networth into GameFi investments.

This survey also revealed that among all age groups, GenZ was the most open to GameFi. GenZ investors allocate 52% on average of their net worth to GameFi. In contrast, GenX investors are the most conservative, with 86% allocating less than 25% of their net worth to GameFi.

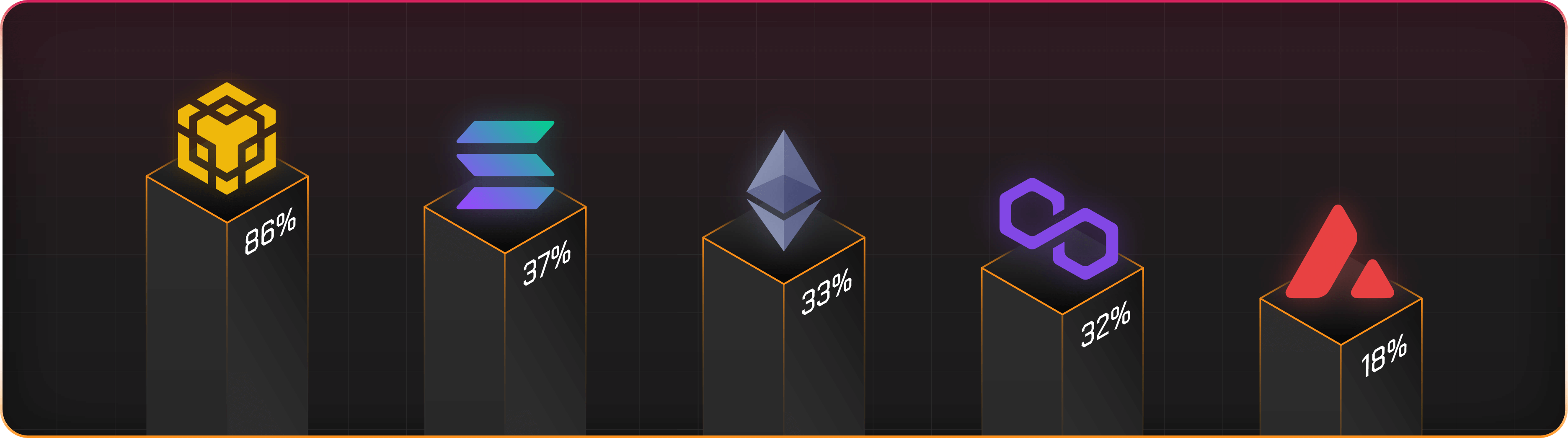

The ever-growing size of the crypto gaming industry has resulted in multiple ecosystems. These ecosystems are the entry points where investors can begin their journey to explore GameFi's benefits.

Among the most popular GameFi ecosystems is BNB Chain, in which 86% of investors have invested. Other ecosystems are also growing due to technology advancements that help reduce trading fees, increase the number of transactions per second and allow the platforms to build better GameFi applications.

Investor preference for these ecosystems shows that 37% of investors prefer Solana, 33% prefer Ethereum, 32% have invested in Polygon, and 18% put their investments in Avalanche.

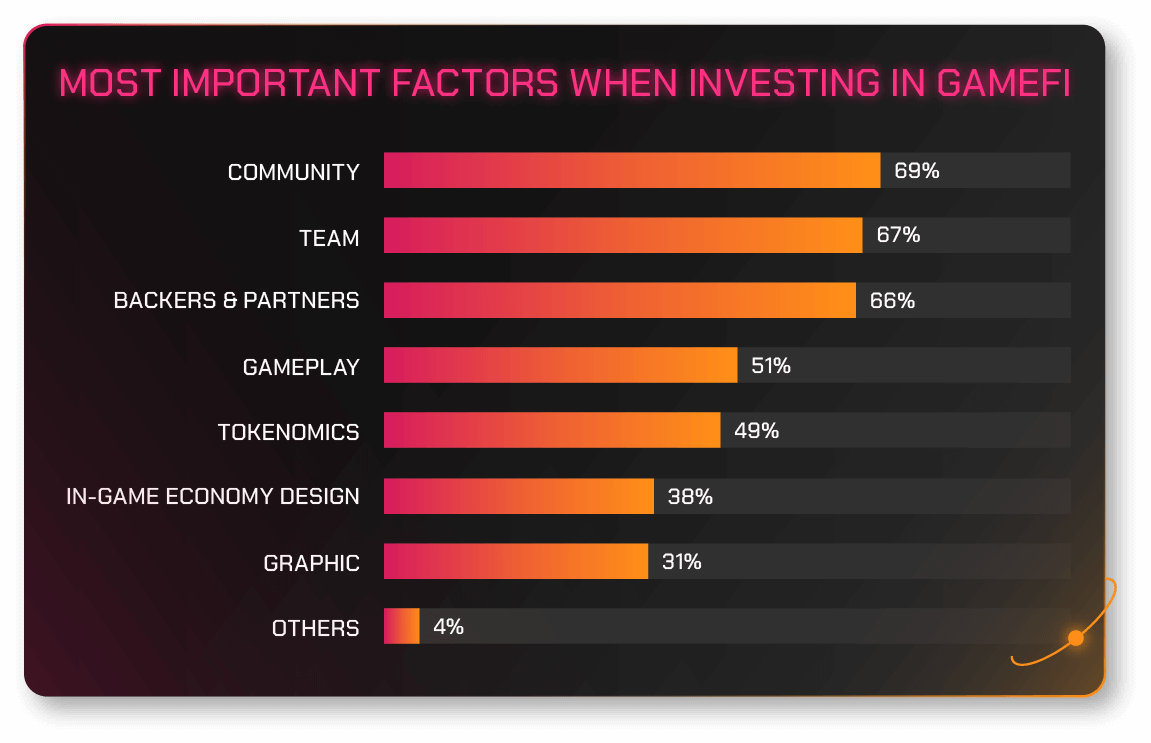

When it comes to the factors you need to consider before investing in a GameFi project, community, backers & partners, and teams still rank as the most important. 69% of investors believe the vibrance of a project's community is an important factor to consider when investing. On the other hand, 66% view backers and partners as the most important investment consideration. Trailing the first two considerations closely is gameplay, which 51% of investors believe to be the most important factor when considering a GameFi investment. 49% of other investors believe that tokenomics hold the most weight in their investment decision, 38% say it's the in-game economy design, 31% consider graphics, while 4% of investors make other considerations.

GameFi has had its glory days and remained a lucrative investment option in crypto until the third and fourth quarter of 2021. But, as more people invest in the sector, profit margins in the sector are decreasing steadily.

According to the survey, 89% of crypto investors worldwide saw their GameFi profits decrease in the last six months. 62% of respondents lost more than 50% of their profits from GameFi.

The drastic drop in profit margins for GameFi investments largely comes from the poor game economy design. The result is that players lose interest, and the game’s performance declines, resulting in heavy losses for investors.

58% of investors worldwide stated that “Poor In-game Economy Design” is the number one reason for declining GameFi profits in the last six months.

The other reason investors gave for the declining GameFi profits is “Reward Token Price Decrease”. 21% of investors believe that the more GameFi tokens have their market value plummet, the more profits are reduced.

Another 6% of investors believe that the “Blockchain-gaming Bubble Burst”. The last category of investors, which formed 15%, believe that the decline in profits resulted from Bitcoin's recent declining performance.

Factors affecting GameFi profits of worldwide investors in the last 6 months

With increased volatility and decreasing returns on investments, it adds up why 82% of the respondents said they spend less time participating in GameFi than they did in 2021.

In 2021, investors worldwide spent an average of 4.4 hours per day participating in GameFi. This figure for 2022 was 2.5 hours per day which is down 43% compared to 2021.

Profit margins are important to any investor, but the reduced profit scales aren't the only reason investors are holding back on investing in GameFi.

The results from our survey indicate that 73% of investors shy away from GameFi investments because they are afraid of rug pulls, Ponzi schemes, and pyramid schemes projects.

This finding says a lot about the present state of GameFi projects. The effort to make these games as decentralized as possible has led to a lack of oversight, which allows fraudsters to profit from the scams they design in the name of GameFi projects.

Besides rug pulls, 42% of investors also avoid further GameFi investments because most games turn out to be repetitive tasks. Instead of being new and exciting, many GameFi projects are repetitive and lack the fun factor. This makes playing games feel more like a chore.

28% of investors cite crappy graphics as the issue that prevents them from participating in GameFi, while 33% mention boring gameplay and 29% say poor profitability is the reason behind their lack of participation.

If GameFi is to remain a lucrative niche in the future, something needs to be done to improve the sector. Here are a few pointers from investors on what they expect from GameFi in the future.

The first step towards restoring GameFi's slowly declining glory is for the industry to prioritize making fun games first before focusing on earning.

This perspective originates from the survey data showing that 81% of GameFi investors prioritize the fun factor over earnings when it comes to future GameFi projects. GameFi will still need an "Earn" factor, but future GameFi projects should focus more on improving game quality. The whole point behind video gaming, be it GameFi or traditional gaming, is to create positive experiences first. Earning ought to be a secondary, not a primary, goal.

In line with that, 88% of respondents stated that they believe in the future of GameFi. So, if the industry improves the quality of games, it is safe to say that it still has a huge fan base.

But, exactly how can GameFi improve itself in the future to maintain its investors?

71% of investors say that “Interesting Gameplay” will keep them hooked to the industry. These investors want GameFi to prioritize fun over earning. This view is supported by another 58% of investors who want graphics to be improved.

55% of investors also believe that GameFi needs to build games with a better reputation. Specifically, they want the industry to partner with well-known game developing companies, especially those involved in PC and console gaming.

The final category, comprising 66% of investors, would want to see better in-game economy design. As discussed earlier, the game economy design was ranked as the number one factor affecting GameFi investor profits in the last six months. Therefore it is no surprise that investors want future GameFi projects to have a better game economy design.

Top 4 factors investors want to see in future GameFi projects

GameFi may have its weak spots, but it also has a chance to grow big in the remaining half of 2022.

From our survey findings, 13% of investors feel that the funding GameFi receives from institutions is one of the biggest drivers of growth for the sector. These funds can help GameFi improve gaming quality and restructure game economy design.

28% of respondents believe that the appearance of AAA games will fuel the growth of GameFi in 2022. AAA games are big-budget games that often incorporate the whos-are-who of the gaming industry. This sentiment aligns with that of 44% of investors who believe that the entry of traditional gaming companies into GameFi is the key driver for GameFi's growth in 2022.

A much smaller percentage of investors, 15% to be precise, say that the growth of crypto, in general, is the secret behind GameFi's growth. Although a smaller percentage holds this view, it is very valid because if crypto thrives, inevitably, GameFi will too.

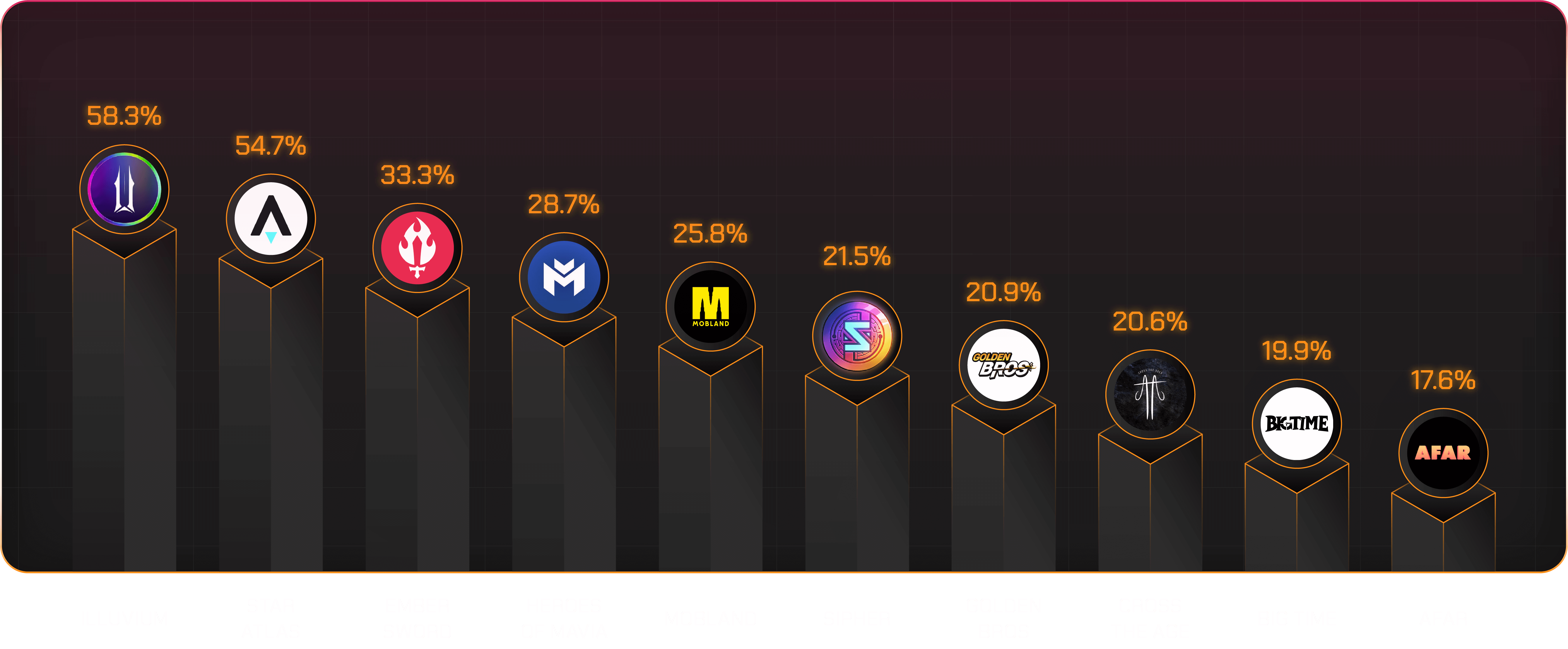

From an investment point of view, there are quite a number of titles to look forward to in 2022. Here’s a list of the 10 most anticipated GameFi projects, with the percentage of investors who are looking forward to each.

Most Anticipated GameFi Projects in 2022

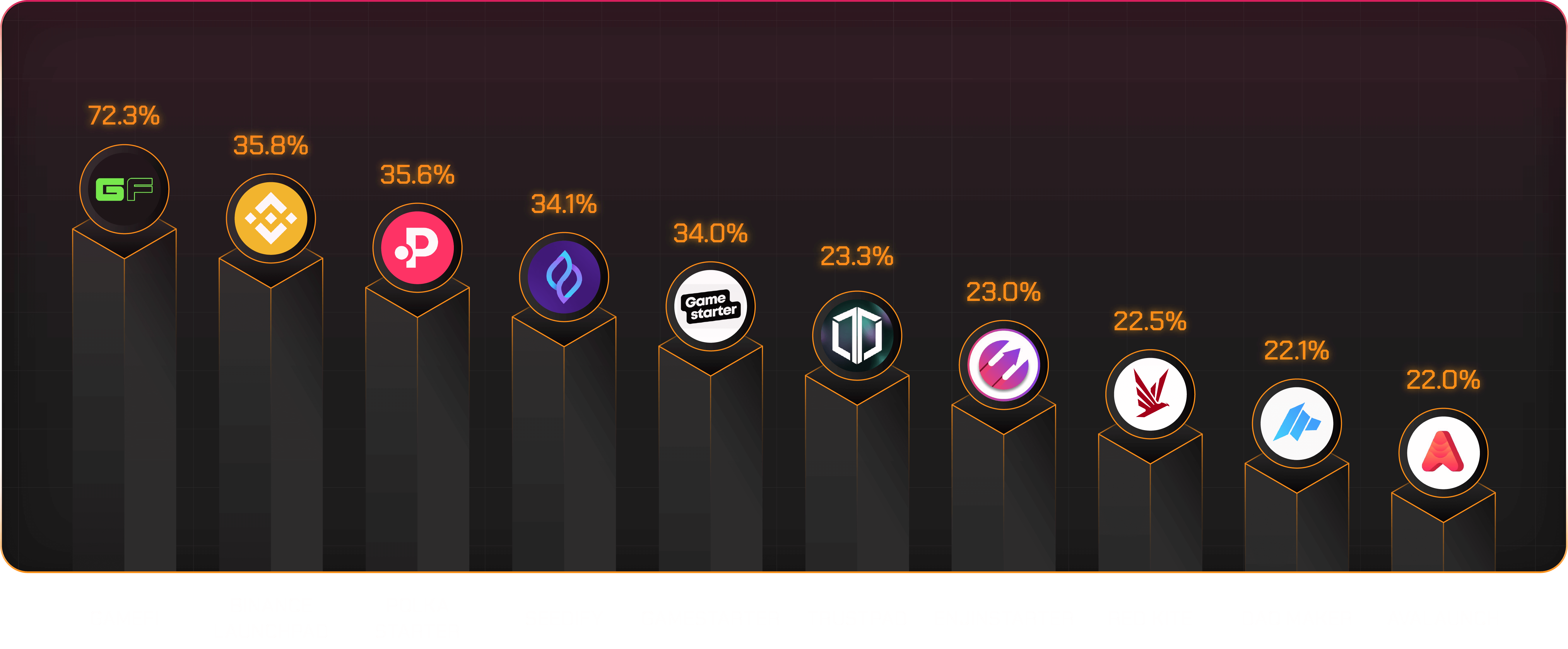

If you want to keep up with the upcoming GameFi projects, you need to find a launchpad with the latest details on the new entries in the market. This list has 10 of the launchpads that investors consider their favorites, and you can use it to find projects that you would want to invest in as soon as they go public.

Most Favorite Gaming Launchpads in 2022

To collect the data shown above, we surveyed 2428 worldwide cryptocurrency investors. Two attention-checker questions were included to ensure the participants did not mindlessly answer questions. Any unqualified responses were excluded from our results. Because the survey relies on self-reporting, issues such as telescoping and exaggeration can influence responses. Please also note that this survey’s results do not reflect our opinions. All information and interpretations contained in this report shall not constitute investment advice.

If you know someone who could benefit from our findings, feel free to share this report with them. The graphics and content are available for noncommercial reuse. All we ask is that you link back to this page so that readers get all the necessary information and our contributors receive proper credit.