News Research

Survey: 92% of Crypto Investors Make Emotional Buying Decisions

ChainPlay

•

2 months ago

Share :

- 92% of crypto investors let emotions override their analysis when making purchases.

- 55% of investment decisions are driven by price and trading volume surge.

- 67% of self-proclaimed long-term investors sell tokens within one year of holding.

Crypto investors insist they research carefully, yet emotions still rule. We surveyed 1000 crypto investors to reveal that 92% admit feelings override analysis, with price spikes, surging volume, and social-media hype triggering impulsive trades. Combined with external studies on FOMO, trading psychology, and social influence, the data expose a stark gap between self-image and reality—and point to concrete ways traders can regain control.

What Crypto Investors Think They Do

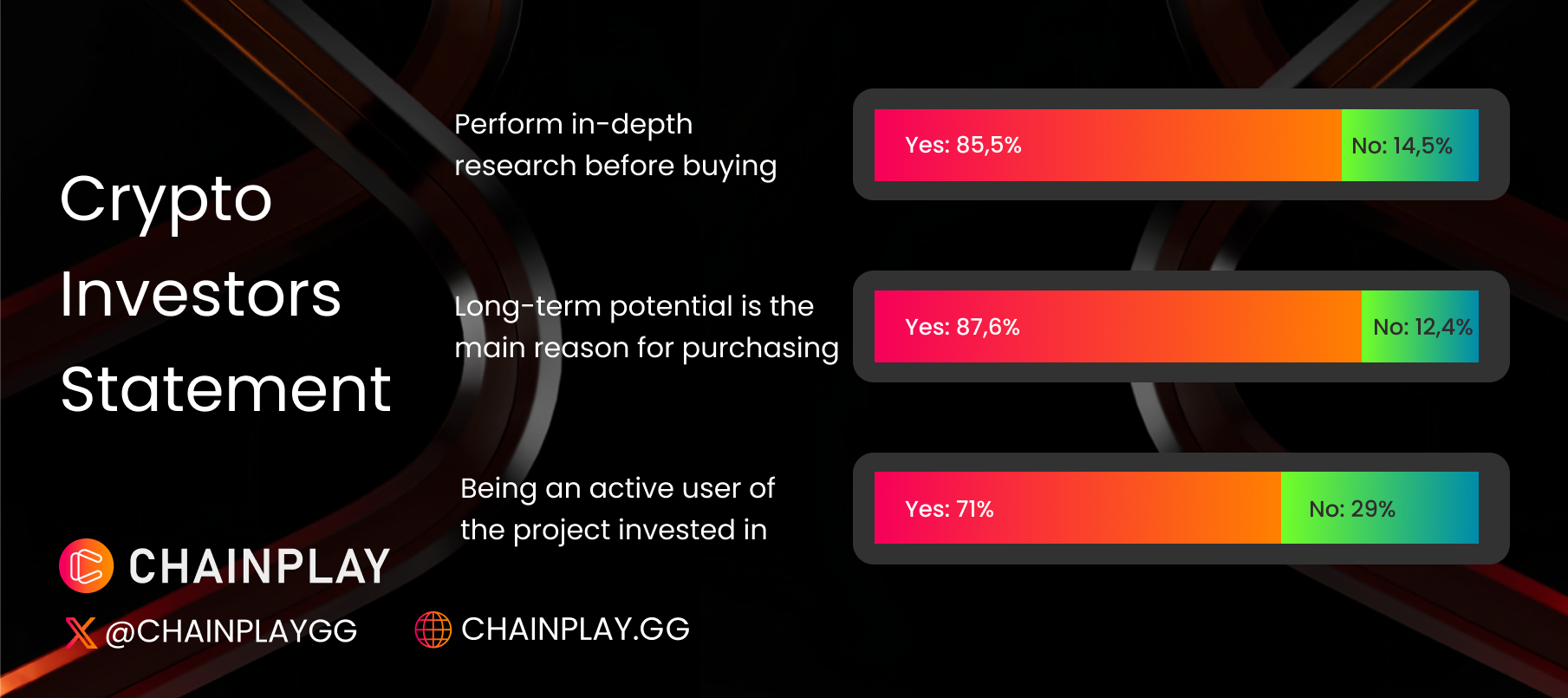

Most respondents paint a picture of disciplined, data-driven investing.

Statement | Yes |

| “I perform in-depth research before buying.” | 85.50% |

| “Long-term potential is my main reason for purchase.” | 87.60% |

| “I’m an active user of the project I invest in.” | 71% |

At first glance, these numbers suggest a remarkably diligent investor base that values fundamental analysis over speculation. However, digging beneath these self-reported behaviors reveals a very different reality

When examining investor self-perception, the data reveals what appears to be a highly sophisticated community. 85.5% of crypto investors claim they perform in-depth research before making any purchase, while an even more impressive 87.6% state that long-term potential is their primary motivation for buying cryptocurrencies. Additionally, 71% report being active users of the projects they invest in.

What They Really Do

Emotional Triggers Override Logic

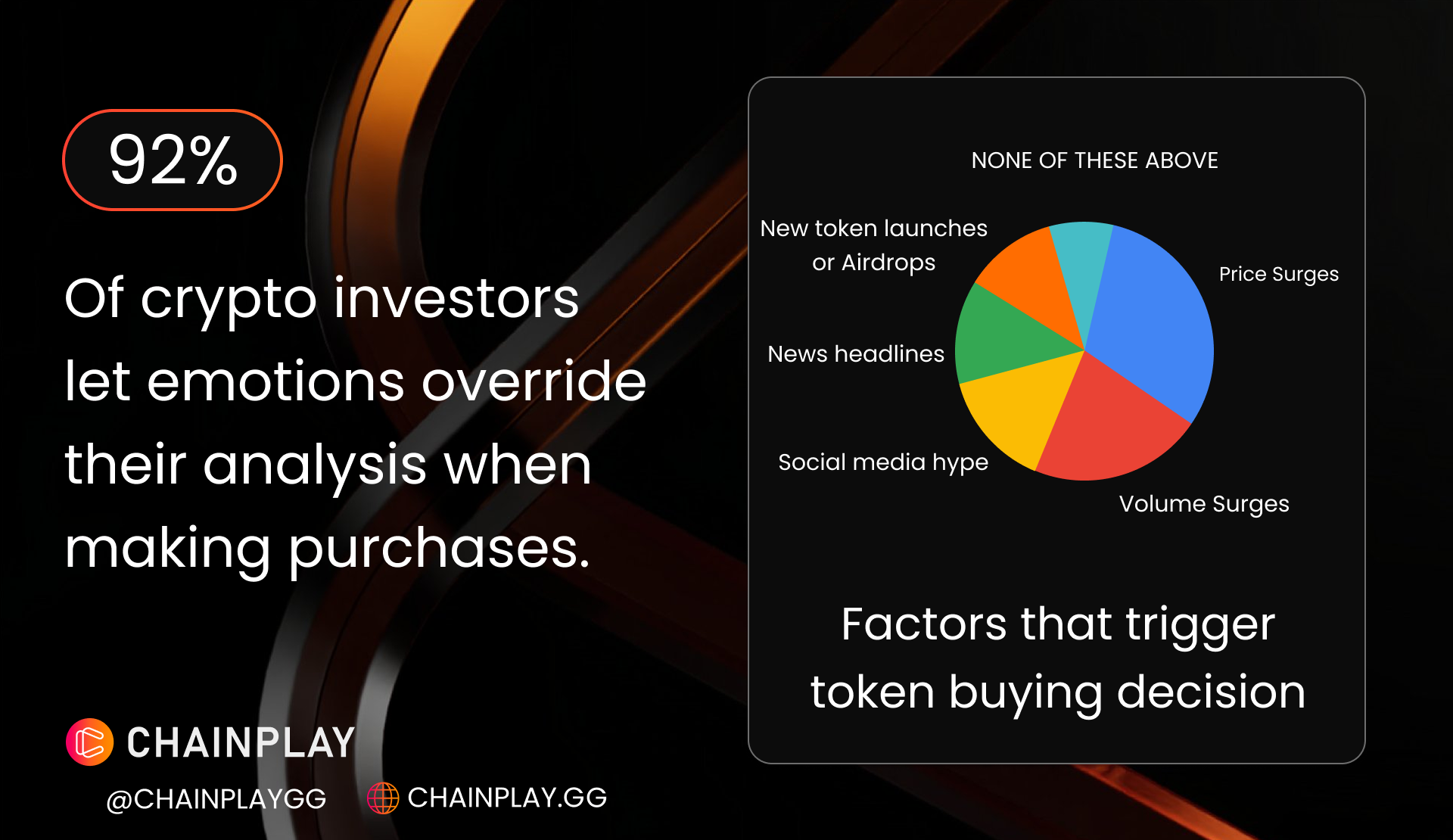

Despite overwhelming claims of rigorous research practices, 92% of investors let their buying decisions were ultimately triggered by emotional factors.

The most common emotional triggers reveal the power of market psychology in driving investment behavior:

- Rapid price surge: 31% of investors

- Trading volume spike: 21.7% of investors

- News headlines and media coverage: 14.6% of investors

- Social media hype: 13% of investors

- New token launches or airdrops: 11.7% of investors

Only 7.9% of investors reported no emotional triggers influencing their investment decisions, highlighting how pervasive emotional decision-making has become in the crypto space. This creates a significant contradiction: while 85.5% claim that emotions ultimately drive their purchasing decisions

The Holding-Period Paradox

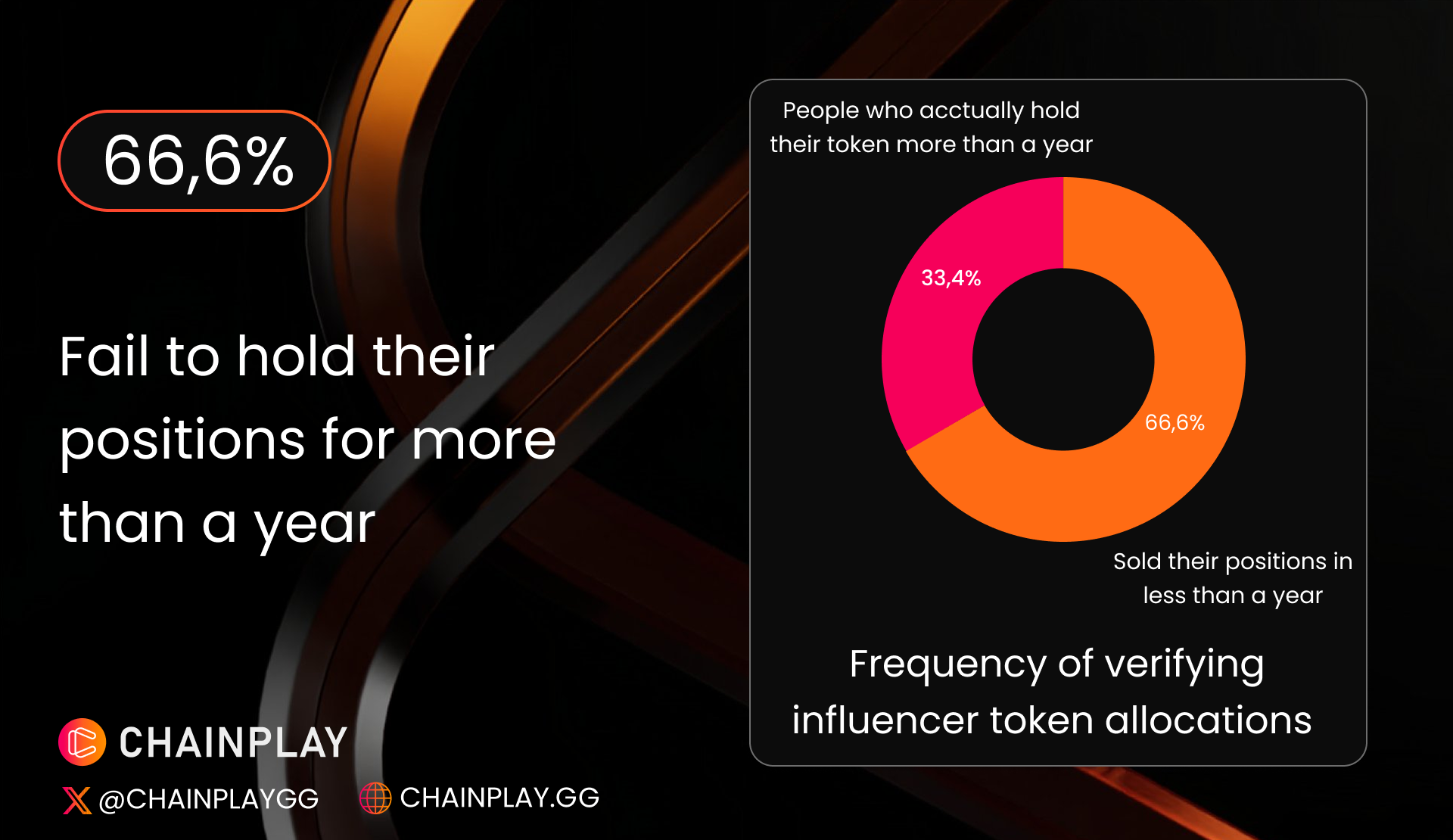

Among investors who claim to buy for "long-term potential," the majority actually sell within twelve months.

The survey uncovers what researchers call "The Holding-Period Paradox." Among self-identified long-term investors, 66.6% sold their positions in less than a year, while only 33.4% managed to hold their investment for over twelve months. This behavior directly contradicts their stated investment philosophy and demonstrates the gap between intention and execution in crypto investing.

Even among self-identified "HODLers," most abandon their positions within twelve months, contradicting their supposed long-term conviction. This pattern suggests that even investors with genuine long-term beliefs struggle to maintain their positions when faced with market volatility and emotional pressure.

KOL Verification Blind Spot

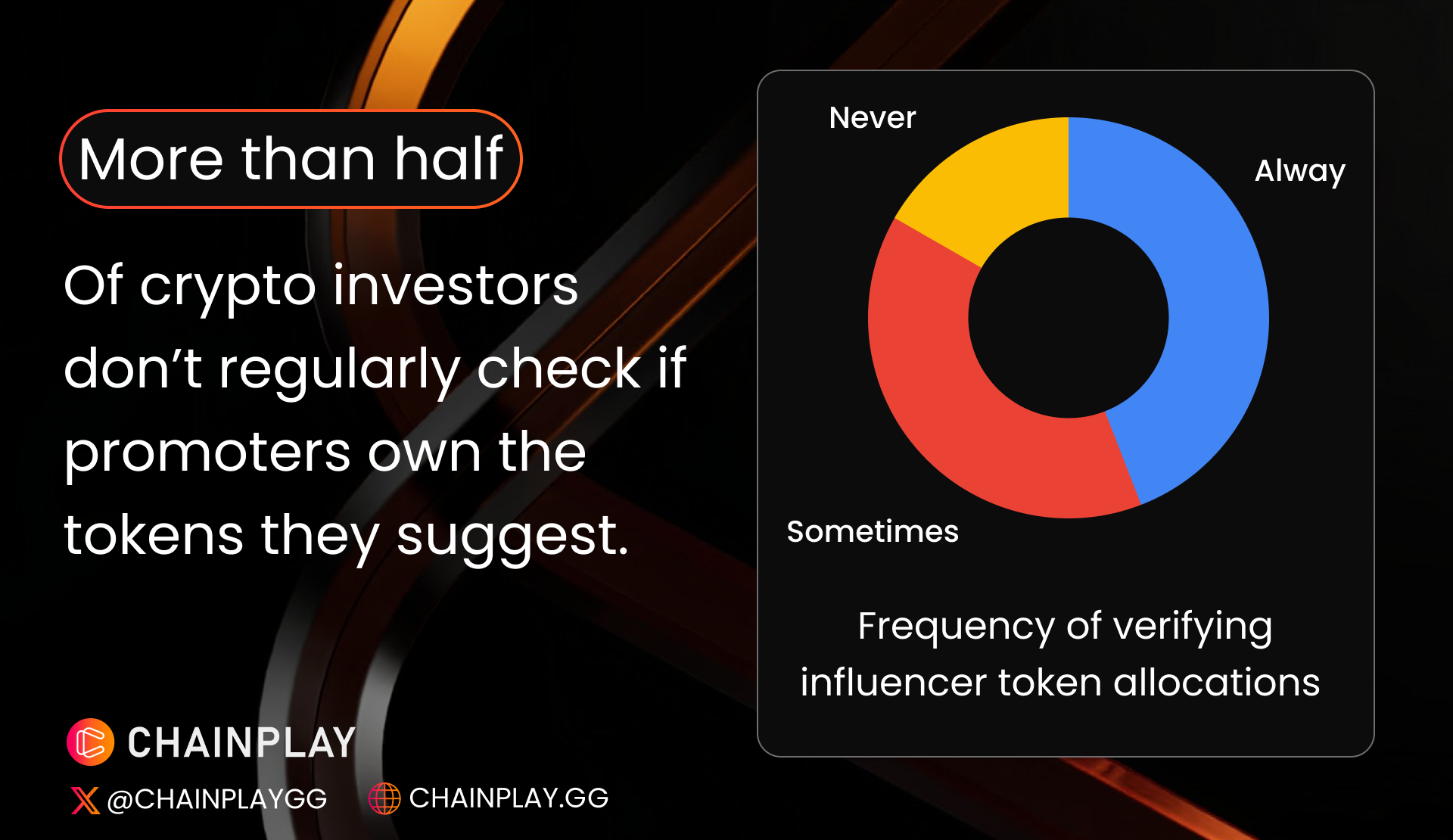

More than half of crypto investors fail to consistently verify whether promoters actually hold the tokens they recommend.

The data reveals a concerning verification gap in how investors evaluate influencer recommendations. 44.1% of investors always check if influencers hold vested tokens in the projects they promote, while 39.2% only sometimes verify this information. Most concerning, 16.7% never check influencer token allocations.

Roughly 56% do not always verify whether a promoter holds vested tokens, creating fuel for pump-and-dump cycles that social media studies routinely flag as problematic. This verification blind spot represents a significant risk factor, as unverified influencer promotions can contribute to speculative bubbles and market manipulation.

Methodology

We surveyed 1000 cryptocurrency investors, with participants recruited through the Prolific, a widely used online research platform to ensure a diverse and representative sample of the active crypto community.

The survey was conducted on July 12, 2025.

Since the findings rely on self-reported data, there is a possibility of biases such as telescoping or exaggeration. The results presented here reflect participant responses and should not be interpreted as investment advice.

Conclusion

The cryptocurrency market reveals a fundamental paradox: while traders believe they operate as rational, research-driven investors, 92% still allow emotions to dictate their buying decisions. Price spikes, volume surges, and online hype exploit psychological biases, effectively erasing the diligent research that investors insist they perform.

Recognizing this emotional influence represents the first step toward better investment outcomes. The survey suggests that adopting systematic strategies and verifying information sources serve as antidotes to FOMO-fueled mistakes. As the crypto market continues to mature, the data indicates that the winning edge will belong not to those who accumulate more information, but to those who can maintain emotional discipline when the market reaches extreme sentiment levels.

Share this article

#Other

Latest News

How casino bonuses influence player behavior and long-term

6 hours ago

NEXUS and Redlab Partner to Grow Onchain Gaming on

6 hours ago

Binance Set for Aria Protocol (ARIAIP) Alpha Launch

6 hours ago

Eldrem Launches Questing Platform and Bestiary App

9 hours ago

Binance Alpha Airdrop and Futures Launch for Folks

yesterday

Related articles

Binance Alpha has announced the launch of Aria Protocol (ARIAIP) with an exclusive airdrop event on November 7. Aria Protocol is revolutionizing the world of intellectual property through tokenization. Here's how to participate in the ARIAIP airdrop.

ChainPlay

•

6 hours ago

NEXUS partners with Redlab Games to expand onchain gaming on the CROSS platform, making blockchain simpler for players and developers.

ChainPlay

•

6 hours ago

Discover how casino bonuses influence player behavior. We explore the psychology, strategic use, and risks of bonuses in online gaming.

ChainPlay

•

6 hours ago