News Research

Vietnam Starts a New Era with a 5-Year Crypto Market Trial

ChainPlay

•

one month ago

Share :

Vietnam boasts enormous potential with over 20 million crypto participants, yet for years this market has struggled in a legal gray area. Now, Resolution 05/2025 opens the door to a 5-year trial period – could this be the turning point for Vietnam to become Southeast Asia's blockchain hub?

The insights in this article were gathered from experts at 5 Minutes Crypto – a community bringing together hundreds of thousands of crypto investors in Vietnam.

When Vietnamese Love Crypto More Than the Rest of the World

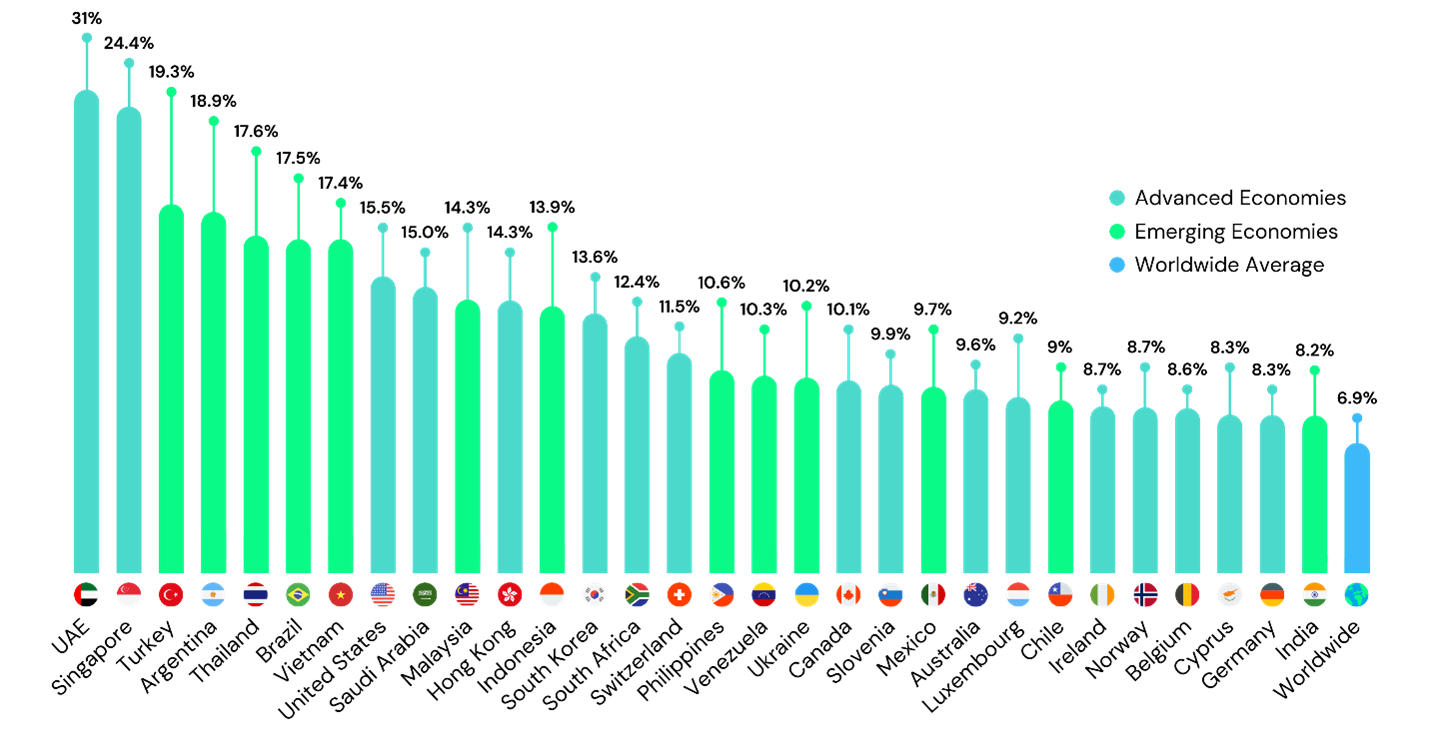

Imagine one in every six Vietnamese has traded Bitcoin or other cryptocurrencies. Triple-A reports a staggering 17.4% adoption rate, placing Vietnam second globally in crypto ownership. Only trailing the UAE – where oil billionaires pour money into Bitcoin like water.

Among them, 7 million are active users, meaning they trade regularly rather than just holding. Chainalysis calculated that funds flowing through Vietnamese wallet addresses reached $105 billion over the past two years. For perspective, this equals roughly one-quarter of the country's GDP. Put another way, if crypto were an economic sector, it would rank among Vietnam's largest contributors.

Moreover, Vietnamese favor high-risk investments. Stocks, gold, real estate, and now crypto. Amid inflation and low savings interest rates, many turn to crypto as a yield-generating channel. Despite knowing the risks, they're willing to test their luck.

Additionally, cross-border transaction costs via crypto are significantly cheaper than traditional banking systems, perfectly suited for Vietnamese remittance and international transfer needs. All these factors have transformed Vietnam into a global digital asset "hotspot."

The Price of Legal Gray Areas

But it's not all rosy. Without state oversight, bad actors run rampant. And citizens have paid dearly.

Many still remember the iFan and Pincoin cases from 2018. 32,000 victims, VND 15 trillion ($660 million) vanished. These projects hosted events at five-star hotels, invited famous singers, and promised 48% monthly returns. Only when they collapsed did people discover the offices were empty shells.

Then came RikVIP with VND 35 trillion ($1.4 billion) in revenue – a staggering figure for a gambling app. In recent years, Forex platforms masquerading as crypto exchanges, high-interest USDT lending apps, and even virtual chicken farming games paying in coins have emerged. Each collapse leaves thousands of families devastated.

Police struggle to act as the law doesn't recognize crypto as property. Citizens lose money but don't know where to turn. Criminals exploit crypto for money laundering and online gambling transfers. It's a chaotic mess where ordinary people suffer most.

Brain Drain and Missed Opportunities

What's more painful: Vietnamese startups must go abroad to thrive. Sky Mavis created Axie Infinity – a blockchain game that once reached a $3 billion valuation – but the company is registered in Singapore. Loi Luu's Kyber Network follows the same path, with hundreds of millions in market cap, yet Vietnam collects no tax revenue.

Numerous other made-in-Vietnam blockchain projects have had to "emigrate": TomoChain (now Viction), Coin98, Ancient8... All founded by Vietnamese, developed by Vietnamese engineers, but legally incorporated overseas. It's not just lost tax revenue. Talented engineers and founders all migrate to Singapore or the US for work.

Vietcetera reports venture capital for Vietnamese tech startups dropped sharply in H1 2024. Foreign investors hesitate to fund a market without clear rules of the game.

Meanwhile, Vietnamese primarily trade on Binance, OKX – international exchanges. Transaction fees, user data – everything flows into foreign company pockets. We have tens of millions of players but reap no benefits. It's like having a gold mine but letting others extract it.

What Has the World Done? Learning from Those Ahead

The UK devised a clever solution in 2012: the regulatory sandbox. The idea is simple yet effective: companies wanting to innovate in fintech can test within a controlled environment. Regulators relax certain rules while maintaining tight supervision.

This approach proved so effective that over 50 countries adopted it, including Singapore, Hong Kong, and the UAE. Thanks to the sandbox, London became Europe's fintech capital. Hundreds of startups successfully raised funds, with many becoming billion-dollar unicorns. Revolut, Monzo, TransferWise (now Wise) – these household names all grew from the UK's sandbox.

Singapore went even further. They not only created a sandbox but actively courted blockchain companies. Tax incentives, streamlined procedures, excellent infrastructure. The result? Singapore is now Asia's crypto capital. Major investment funds, exchanges, and blockchain projects all headquarter there.

And China? Complete ban. Yet citizens still play underground, money still flows out through covert channels. Chinese Bitcoin miners migrated en masse to Kazakhstan and the US. Meanwhile, countries with completely open policies saw bubbles burst spectacularly, citizens losing fortunes. Clearly, the middle path works best – neither extreme prohibition nor reckless deregulation.

Resolution 05/2025: Vietnam Charts Its Own Course

In September 2025, the Vietnamese Government decided on a 5-year trial with digital assets. Not banning like China, not fully liberalizing like some countries, but choosing a cautious exploration. A prudent yet necessary step.

Want to open an exchange? You'll need VND 10 trillion ($400 million) in capital. This hefty requirement will certainly exclude most small startups – only major corporations can afford to play. Many consider it too strict, but perhaps the government wants to ensure only truly capable organizations participate in this initial phase.

Digital assets must be backed by real assets – no more printing coins from thin air to sell to citizens. This helps prevent iFan and Pincoin-style scams. Trading must be in Vietnamese dong, not USD or USDT. A way to control money flows and collect taxes effectively.

Citizens wanting to trade must use licensed exchanges. Six months after the first exchange launches, anyone still using unlicensed platforms faces penalties. This is crucial – they're not banning citizen participation, just requiring official channels. Taxes temporarily follow stock trading rules, pending specific legislation.

The Ministry of Finance states clearly: this is an experiment for learning, not a free-for-all opening aimed at balancing citizen protection with development opportunities.

Opportunities and Challenges Go Hand in Hand

According to experts from 5phutcrypto.io, Resolution 05 opens many prospects.

- First, blockchain startups no longer need to go abroad. They can register companies in Vietnam, pay taxes in Vietnam, create jobs for Vietnamese. The next Sky Mavis, the next Axie Infinity could be born and grow right in their homeland.

- Second, investors gain legal protection. No more losing money with nowhere to turn. Disputes have resolution mechanisms. Fraud faces legal prosecution. Market confidence will be restored.

- Third, the state collects taxes and controls money flows. With a potential multi-billion dollar market, tax revenue could be substantial. Meanwhile, supervision helps prevent money laundering and terrorism financing.

With existing advantages – young population, high crypto adoption – Vietnam could absolutely become Southeast Asia's blockchain hub.

But challenges loom large. VND 10 trillion is excessive for most businesses. With only 2-3 exchanges, will there be sufficient competition? Low liquidity, high fees – users will return to Binance. Capital requirements should be gradually reduced over time.

Blockchain technology is complex, requiring skilled personnel for operation and supervision. Currently, Vietnam lacks experts deeply knowledgeable in blockchain, crypto, and smart contracts. Urgent training is needed to meet demand. Hacking and fraud risks still lurk without careful precautions. Exchanges must invest heavily in security and establish compensation mechanisms for incidents.

Share this article

#Other

Latest News

Binance Alpha To Open Trading for THORWallet (TITN)

2 hours ago

Earn 600+ Gems in ROHAN 2’s Immutable Onboarding Quest

20 hours ago

Innovate NY Launches New York City Student Education

yesterday

Binance Announces Kite (KITE) Alpha Launch and Airdrop

2 days ago

Bitcoin in gaming: Sports betting on BTC

2 days ago

Related articles

Innovate NY PAC's NYC blockchain education plan, supporting A. Cuomo, aims to build a STEM facility and generate $2.8B in annual output.

ChainPlay

•

yesterday

ROHAN 2 and Immutable launch an Onboarding Quest with 600+ Gem rewards and upcoming $CROSS token prizes for players.

ChainPlay

•

20 hours ago

Binance Alpha is set to list THORWallet (TITN), the popular self-custodial wallet, on November 3, featuring an exclusive airdrop event for early participants. The airdrop will cost 15 Alpha points and is on a first-come, first-served basis.

ChainPlay

•

2 hours ago