News

Solv Protocol Introduces BTC+ Vault for Automated Yield Generation on Bitcoin Holdings

ChainPlay

•

13 hours ago

Share :

Solv Protocol, a DeFi platform pioneering a decentralized Bitcoin reserve, has announced the launch of BTC+, a structured yield vault for generating returns on institutional Bitcoin holdings. The new BTC+ vault launched by Solv seeks to earn profits on over $1 trillion worth of Bitcoin lying idle.

Solv Protocol Targets Over $1 Trillion in Idle Bitcoin

On Thursday, July 31, Solv Protocol announced the launch of a new Bitcoin yield-bearing product, BTC+, for idle Bitcoin. Over $1 trillion in BTC held by institutional investors currently sits idle on spot exchange-traded funds.

With the BTC+ vault, institutional investors can now earn returns on their Bitcoin holdings securely and efficiently. Thus, BTC+ is transforming Bitcoin from a passive store of value into an active, yield-generating asset.

Ryan Chow, the co-founder of Solv Protocol, said in a statement that the BTC+ vault is a product born from institutional finance and will be "accessible to anyone who believes Bitcoin should do more than sit idle."

This next-generation automated yield vault deploys capital across capital held in the vault across various yield strategies, including decentralized finance (DeFi), centralized finance (CeFi) and traditional finance markets.

How BTC+ Automated Vault Works

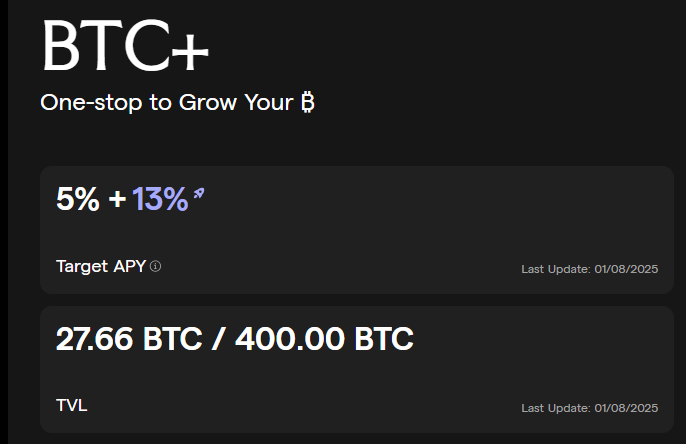

The BTC+ vault will generate returns across markets to offer more stable returns, an improvement on simple staking or lending. The BTC+ vault is targeting annualized returns of 4.5%-5.5%. According to the report, BTC+ includes strategies such as:

- DeFi Credit Markets: Lending BTC to maximize returns with minimal risk.

- Protocol Staking: BTC will be staked on protocols for on-chain rewards.

- Basis Arbitrage: Exploiting price differences between spot and derivatives markets.

- Tokenized Real-World Assets: BTC will be put into yield-bearing products like BlackRock's BUIDL fund to increase real-world exposure.

- Delta-neutral Funding Rate Arbitrage

According to the announcement, early depositors can get their returns boosted up to 99.99% on BTC-denominated yield. On August 1, the same day the vault went live, more than 27.66 BTC ($3.19 million at current prices) has already been locked in the vault.

Security Features of the BTC+ Vault

Solv Protocol has put in place several advanced security features to better serve its institutional clients. Among them is the dual architecture, where custody (safe storage of BTC) and execution (the deployment of yield strategies) are separated. This model enhances security and renders the vault attractive to risk averse institutions and retail investors.

BTC+ implements real-time, on-chain Proof-of-Reserves by Chainlink so that the funds of users are always 100 percent collateralized. Additionally, the NAV-linked drawdown protections and in-built risk separation serve to protect against market fluctuation and ensure users do not lose their money.

Also, there is a BTC+ vault that is Shariah-compliant. This allows broader availability to institutions in the Middle East and anyone who may require products that comply with the regulations of Islamic banking.

Growing Demand for Bitcoin Yield Products

The launch of BTC+ shines light on the growing demand for yield-bearing products among BTC holders. This shows Bitcoin is gradually transitioning from a store of value into an income-bearing product. Ryan Chow adds that although Bitcoin is one of the most powerful forms of collateral in the world, "its yield potential has remained underutilized."

Solv is not the only company that targets the emerging Bitcoin yield market. Crypto exchange Coinbase introduced an institutional-only Bitcoin yield fund in April to clients outside of the U.S., promising returns as high as 8% using a cash-and-carry strategy. XBTO has also collaborated with Arab Bank Switzerland to provide a Bitcoin yield product that has a yield of about 5% annually.

Share this article

#Other

Latest News

Spheron and Warden Protocol Launch Reward Campaign

13 hours ago

Solv Protocol Introduces BTC+ Vault for Automated Yield

13 hours ago

Sky Mavis Launches $400K Ronin Forge Innovation Grant

2 days ago

PEPETO, The Real PEPE Crypto Price Prediction: When

2 days ago

L3E7 Launches Season 0: First 3D Earth-Based Blockchain

2 days ago

Related articles

Learn when PEPETO might reach a 20,000% rally as its presale, staking rewards, and powerful tokenomics position it for explosive market growth.

ChainPlay

•

2 days ago

Sky Mavis, the team behind Axie Infinity and developer of the Ronin blockchain, has announced the Ronin Forge Innovation Grant.

ChainPlay

•

2 days ago

Spheron teams up with Warden Protocol for a Galxe campaign, offering rewards, early access, and secure Web3 features before Warden’s beta launch.

ChainPlay

•

13 hours ago